Personal loans are one of the best types of loans which will come in handy when we need the money urgently. However, it does not mean we go for any types of personal loan. Hence, in this post, I will try to list the comparative chart which makes you select the best Personal Loan Interest Rate December 2017.

There are two kinds of interest rates like fixed and variable or floating. You can choose which type of interest preferable to you based on your loan amount.

The fixed rate personal loan is where the rate of interest is locked throughout the life of the personal loan, this cannot be changed at any time even if the rate falls or goes up over the coming years.

The variable rate personal loan is opposite to it, where the rate is subject to market volatility. If the interest rate in the market falls, you will have to just pay the reduced rates and vice versa.

The fixed rate is a kind of hedging of market volatility, variable rates are helpful if you are expecting the interest rate in the market will fall.

What affects your personal loan interest rate?

- Income Level- The rate is totally dependent on the income level and the company where you are working. This information is compared with the loan amount and they will gauge if you are capable to repay the loan without defaulting. According to the risk involved in your repayment strategy, the interest rate varies.

- Loan Tenure: Usually shorter the loan in the higher the interest rate will be and vice versa. EMIs are regular and fixed return for lending banks, thus when the return is for long period the rate will decrease respectively.

- Credit Rating of the Individual: Financial institutes conduct CIBIL check to understand the creditworthiness of the borrowers. In case of any default payment records, huge outstanding loan, fraudulent track records, banks has every right to cancel the loan or charge a higher interest rate. Hence, it is very much important to keep the good track record of your credit score and repay your dues timely.

Fees and Charges Applicable to Personal Loan

There are different ways of charging by each bank. However, when you notice about charges, you will find these three common types of charges.

- Processing Fee: This is the non-refundable processing fee, this will be different depending on the loan particulars and bank’s policies.

- Part Payment/ Part Pre-Payment Charges: When you pre-pay loan or part of principal payable by you, automatically banks lose some income because of this. Hence, they charge for this. You have to cross check this charges also.

- Payment Delay Charges: An additional charge is levied by every bank on the outstanding amount that is not repaid within the specific date. It is essential to make sure payment/ EMIs are processed within the deadline to avoid these charges.

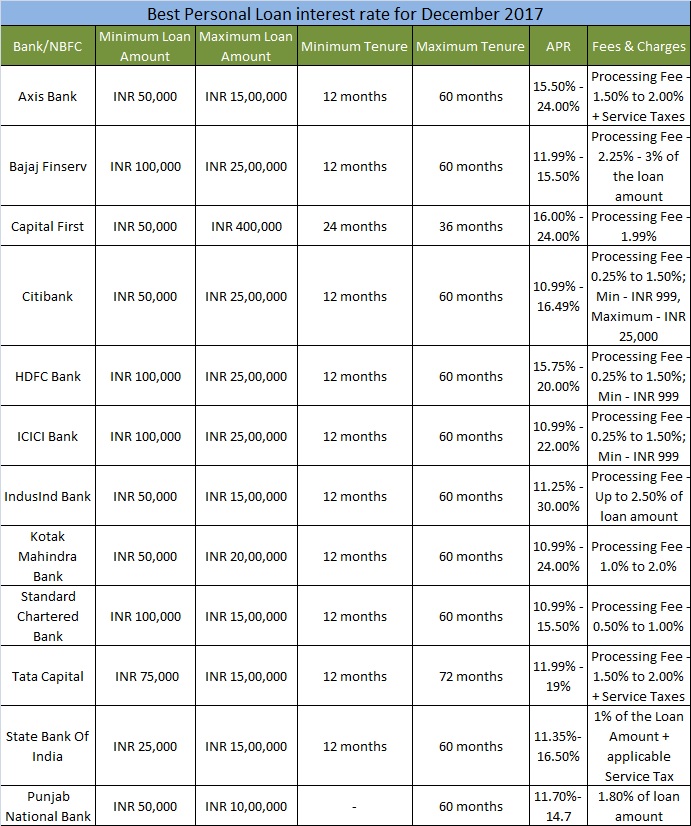

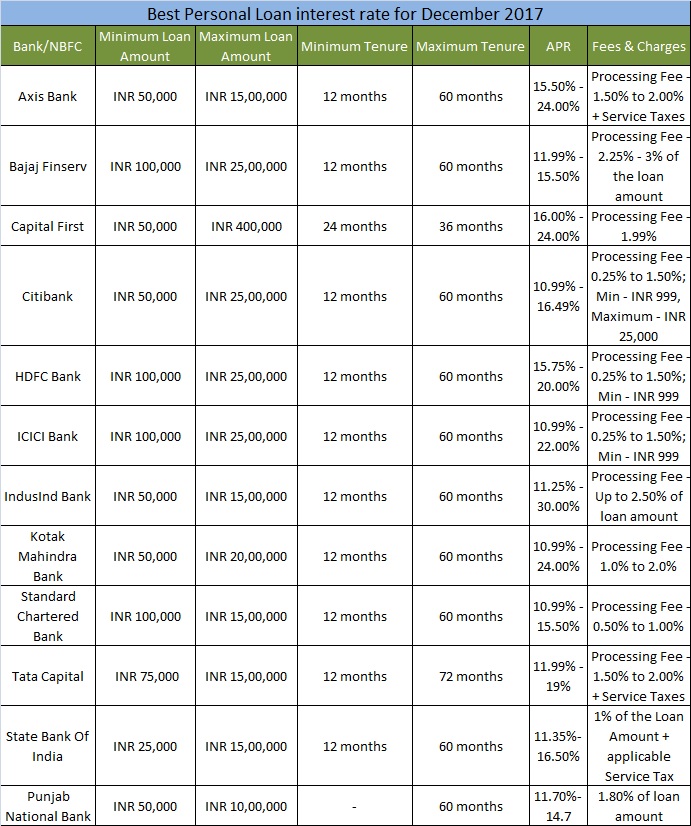

Best Personal Loan Interest Rate December 2017

Now let us discuss about the best personal loan interest rate December 2017. I tried my best to provide you the complete picture and comparative table. However, I suggest you to cross check with the bank before proceeding further.

Hope this information is useful for you to take an informed decision while going for a personal loan.